China’s Financial Sector Opening-up Policies

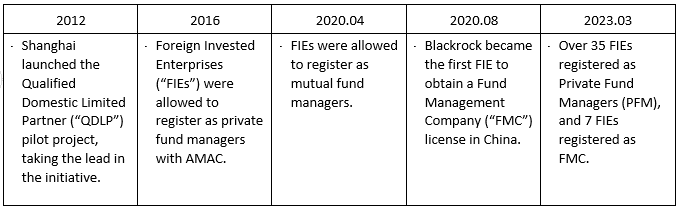

In 2016, the Asset Management Association of China (“AMAC”) issued guidelines, specifically Q&A No.10, which highlighted that Private Fund Management Companies (“PFM”) can now be established as either wholly foreign-owned or as Sino-foreign equity joint ventures between foreign and Chinese entities. Additionally, these PFMs are allowed to register as fund managers with AMAC.

On 1 January 2020, financial authorities removed the limits on foreign ownership of futures companies operating in China. This was followed by the removal of caps on foreign ownership of Mutual Fund Companies on 1 April 2020 and on securities companies on 1 December 2020.

In other words, Foreign Invested Enterprises (“FIEs”) cannot operate any public funds until Y2023. Currently, only 7 registered Foreign Invested Enterprises have obtained FMC licenses, granting them the ability to operate public funds in the market.

Fund Operation Model

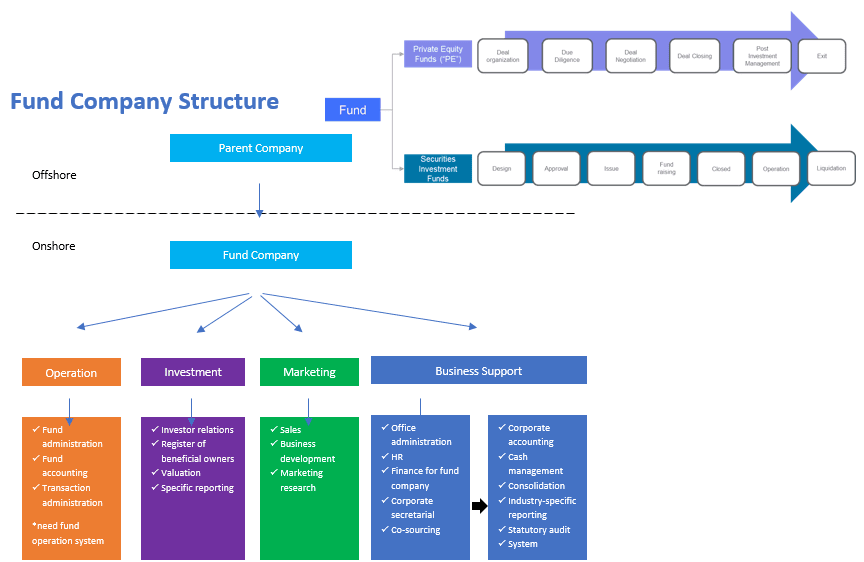

Fund management generally includes Private Equity Funds and Securities Investment Funds.

Private Equity (“PE”):

- Invests in the equity of non-publicly traded companies or publicly traded companies' non-publicly traded equity.

- Typically managed by a GP who privately raises funds from LPs.

- Invests in private companies through equity investments, with consideration for future exit mechanisms such as IPO, M&A, or management buyout.

- Consists of various investment types, including debt, equity, and real estate.

Securities Investment Funds:

- Primarily invests in securities and other financial derivatives.

- Managed by the fund manager with a self-designed investment strategy.

- Established as open-ended funds, allowing investors to redeem their investment at the net asset value.

- Invests in publicly traded stocks, non-publicly traded stocks, government bonds, corporate bonds, financial bonds, money market instruments, asset-backed securities, and warrants in China

Typically, a fund management company consists of key departments such as Operations, Investment, Marketing and Business Support.

During the initial stages, foreign-invested fund management companies usually focus on obtaining licenses and building operational, marketing, and Investment teams to prepare their products for market entry. Additionally, there is a policy that requires accountants for Private Fund Management (PFM) and Fund Management Companies (FMC) to be in separate teams with strict due diligence requirements.

As a result, when these companies shift their attention to the business support function, they may face two challenges:

- Insufficient headcount to cover the business support, especially in terms of professional accounting and tax filing.

- A shortage of time and lack of additional resources to recruit suitable personnel

What we can offer?

Corporate Accounting

- Bookkeeping

- PRC Reports

Cash Management

- Procurement Process

- Payment Process

Consolidation Report

- Group Reports

Industry-specific Reporting

- CSRC Regulator Reports

- AMAC Regulator Reports

Annual Services

- Statutory Audit Assistance

- Internal Audit Assistance

- Annual Inspection

- Annual CIT Assessment Assistance

System Implementation

- Blueprint Design

- Standard Operating Procedures (SOP) Design

- System Configuration

- User Acceptance Testing (UAT)

- Training

China Updates

Accounting and Taxation

- On 6 June, according to the website of the State Administration of Taxation (SAT), the Announcement of the State Administration of Taxation on the Application of the Multilateral Convention on the Implementation of Measures Relating to Tax Treaties to Prevent Base Erosion and Profit Shifting to the Bilateral Tax Agreements between China and Bulgaria and Other Countries (SAT Announcement No. 9 of 2023) was released to the public.

In August 2022, the SAT issued SAT Announcement No. 16 of 2022, announcing the entry into force of the Multilateral Convention on the Implementation of Measures Concerning Tax Treaties to Prevent Base Erosion and Profit Shifting ("the Convention") for China and its first batch of application to the 47 tax treaties signed by China. Subsequently, other countries have completed the application procedures for the entry into force of the Convention. As of 30 April 2023, the number of tax treaties signed by China to which the Convention applies has increased by 6, including Bulgaria, Indonesia, Mexico, Romania, Russia, and South Africa. The time of commencement of the application will be determined in accordance with Article 35 (Commencement of Application) of the Convention.

- To better support the innovative development of enterprises, the State Tax Administration and Ministry of Finance jointly issued “Announcement on Matters Related to the Optimisation of the R&D Expense Super-Deduction Policy for Prepayment Tax Filing” [2023] No. 11, effective from January 1, 2023.

The new policy allows enterprises that can accurately collect and calculate the R&D expenses to choose enjoying the R&D super-deduction policy based on their operational condition for the first half of the year in July when filing for quarterly CIT return for the second quarter or monthly CIT return for June, in addition to the October prepayment tax filing and annual CIT filing.

The implementation of the new policy allows taxpayers to enjoy the R&D super-deduction policy earlier, effectively easing cash flow pressure.

- In July 2023, the State Taxation Administration and the Ministry of Science and Technology jointly issued the "Guidelines for the Implementation of the Policy on Deduction of R&D Expenses (Version 2.0)". Building on the 1.0 version, the 2.0 version comprehensively sorted out the current policies related to the super-deduction of R&D expenses and provided comprehensive and further interpretation of the policies from the aspects of content, accounting requirements, filing, and post-filing management.

Human Resources

- A Notice on Adjusting Payment Standards of Unemployment Insurance Benefits in Shanghai was released by the Shanghai Municipal Human Resources and Social Security Bureau

1. The unemployment insurance benefits can be paid and calculated for the unemployed who meet the conditions according to the following standards:

- For the unemployed receiving unemployment insurance benefits for the 1st-12th months, the payment standard is RMB 2,175 per month;

- For the unemployed receiving unemployment insurance benefits for the 13th-24th months, the payment standard is RMB 1,740 per month;

- For the unemployed who have extended the period of receiving unemployment insurance benefits, the payment standard is RMB 1,510 per month.

2. The unemployment insurance benefits can be paid and calculated for the unemployed who meet the conditions according to the following standards:

[Something missing here? What are the standards?]

Corporate Governance

- On 19 July 2023, the Ministry of Commerce of the People’s Republic of China expressed its intention to reasonably reduce the items in the Negative Lists for Foreign Investment to further remove or relax foreign investment access restrictions. Additionally, it aims to deepen the construction of National Comprehensive Demonstration Zones for Expanding and Opening up the Service Sector and revise the Administrative Measures on Strategic Investment in Listed Companies by Foreign Investors to further relax the restrictions on strategic investment by foreign investors in listed companies.

Contact Us

Tan Lee Lee

Head of China

TanLeeLee@SBASF.com

Rita Boyle

Director, Business Advisory, International Desk

RitaBoyle@SBASF.com

Yeo Lee Soon

Director, China Business Advisory, Singapore

YeoLeeSoon@SBASF.com