Amendments to China’s Individual Income Tax Law (‘IIT law’) were approved by the Standing Committee of the 13th National People’s Congress (NPC) on 31 August 2018 and took effect on 1 January 2019. The key changes that affect individual taxpayers and employers are summarised below.

1. Revised definition of China tax resident/non-tax resident

Previously, if an expatriate stays in China for a full calendar year, he or she will be deemed as a China tax resident. Otherwise, the expatriate is a China non-tax resident. ‘Full calendar year’ means that no subtraction shall be made for the days of temporary absence from China within the calendar year, and temporary absence from China refers to absence for a continuous period of not more than 30 days in a calendar year.

According to the amended IIT law, an individual who stays in China for 183 days or more within a calendar year will be deemed as a China resident and subject to China IIT on worldwide income. Further clarification is required as to the definition of worldwide income taxable in China.

However, the six-year rule for foreign China tax residents is still valid, i.e. overseas incomes (such as capital gain on property transfer, dividend income derived from overseas entity, etc.) shall be exempted from China IIT if the foreign individual stays in China for less than five continuous full years.

2. Consolidation of taxable income categories

The categories of ‘income’ subject to IIT have been consolidated under the revised IIT law. Four income subcategories — wage and salary, labour remuneration, author’s remuneration and royalties — have been consolidated into a ‘Comprehensive Income’ category subject to a 3% – 45% progressive tax rate. This and the tax rates for the remaining income categories under the amended IIT law are shown in the table below.

Comparison of Previous and Amended Income Categories

| Previous IIT law |

|

Amended IIT law |

|

| Categories |

Tax rate (%) |

Categories |

Tax rate (%) |

| Income from salary and wages |

3 – 45

(7 tax brackets in total) |

Comprehensive income:

- Income from wage and salary

- Income from labour remuneration (20% exemption)

- Income from author’s remuneration (44% exemption)

- Income from royalties

(20% exemption)

|

3 – 45

(7 tax brackets in total) |

| Income from independent personal services |

20 – 40

(3 tax brackets in total) |

| Income from author’s remuneration |

20 |

Income from royalties

|

20 |

Income from sole proprietors and merchant’s production and business operations

|

5 – 35

(5 tax brackets in total) |

Income from business operation

|

5 – 35

(5 tax brackets in total)

|

| Income from contracting/ leasing services provided to enterprises and institutions |

5 – 35

(5 tax brackets in total)

|

| Income from interest, stock dividends and bonuses |

20

|

Income from interest, dividends and bonuses

Income from leasing of property

Income from transfer of property

Occasional income

|

20 |

Income from lease or transfer of property

|

20 |

Contingent income

|

20 |

Other income

|

20 |

Abolished |

N/A |

3. Deductions

a. Standard monthly deduction

Since 1 October 2018, the standard deduction on comprehensive income has increased to RMB60,000 on an annual basis, or RMB 5,000 per month, for all tax residents.

For non-tax residents, the standard deduction is now RMB5,000 per month and the tax filing should be handled on a monthly basis or whenever income is earned.

Comparison of Previous and Amended Standard Monthly Deductions

| Previous |

Amended |

Resident Taxpayer (RMB)

|

Non-resident Taxpayer (RMB)

|

Resident Taxpayer (RMB)

|

Non-resident Taxpayer (RMB) |

| 3,500 |

4,800 |

5,000 |

b. Specific additional deductions

Under the amended IIT law, a new category, ‘Specific additional deductions’, will be applicable to resident taxpayers for expenses related to the following:

- Education expenses for children

- Expenses for further self-education

- Healthcare costs for serious illness

- Housing loan interest or housing rent

- Support for elderly

The implementation details are yet to be released.

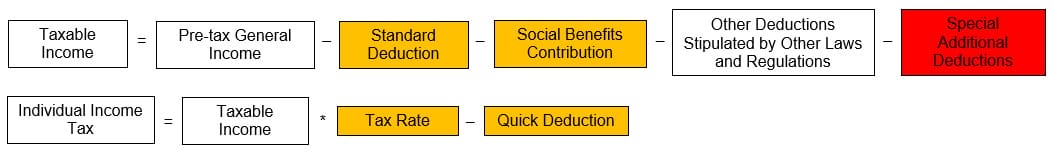

4. Calculation of IIT on comprehensive income

The monthly formula to calculate IIT on comprehensive income is updated as follows, with the new and amended components shown in the red and orange boxes respectively.

5. Adjustments in income tax brackets

Adjustments in income tax brackets for monthly comprehensive incomes with effect from 1 October 2018 are shown in the table below. Lower income tax brackets have been expanded, resulting in the application of lower income tax rates on a wider range of income levels, while the higher tax brackets remain the same.

Previous and New Monthly Tax Brackets for IIT

| Previous Bracket (RMB) |

New Bracket (RMB) |

Effect |

IIT Rate (%) |

New Quick Deduction (RMB) |

| <1,500 |

<3,000 |

Expanded |

3 |

0 |

| 1,500 – <4,500 |

3,000 – <12,000 |

Expanded |

10 |

210 |

| 4,500 – <9,000 |

12,000 – <25,000 |

Expanded |

20 |

1,410 |

| 9,000 – <35,000 |

25,000 – <35,000 |

Narrowed

|

25 |

2,660

|

| 35,000 – <55,000 |

35,000 – <55,000 |

Unchanged

|

30 |

4,410

|

| 55,000 – 80,000 |

55,000 – 80,000 |

Unchanged |

35 |

7,160 |

| >80,000 |

>80,000 |

Unchanged |

40 |

15,160 |

6. Enforcement

a. Unique taxpayer identification numbers

Every taxpayer shall have a unique taxpayer identification number. Where a taxpayer has the Chinese Resident Identity Card, his or her Chinese Resident Identity Card number shall be the taxpayer identification number. Otherwise, the tax authority will assign a taxpayer identification number.

b. IIT liability for resident taxpayers now on an annual basis

IIT will now be calculated on an annual rather than monthly basis for tax residents according to the amended IIT law.

However, withholding agents will continue to withhold the tax in advance on a monthly basis and non-residents will continue to pay tax on a monthly or subordinate basis.

c. Tax authorities given additional anti-tax avoidance powers

The tax authorities will be given additional powers to enforce tax liabilities particularly on transactions involving non-arm’s length asset transfers, offshore tax avoidance schemes, and commercial arrangements where inappropriate tax benefits are derived.

7. Significant benefit for low to mid-income earners

Low to mid-income earners will benefit significantly from the expansion of the lower tax brackets as shown in the example below for a Shanghai employee.

| Pre-tax Income (RMB) |

Social Benefits

Contribution (RMB)

|

Previous

|

New

|

Decrease in Tax (%) |

| Applicable Tax Rate (%) |

IIT (RMB) |

Applicable Tax Rate (%) |

IIT (RMB) |

10,000

|

1,750 |

20 |

395 |

10

|

115 |

70.9 |

| 20,000 |

3,500

|

25 |

2,245 |

10

|

940 |

58.1 |

85,000

|

3,744.3

|

35 |

21,709.2

|

35 |

19,529.2

|

10.0 |

The IIT reform marks a significant change in China’s taxation policies, with the tax authorities given greater capabilities to enforce rules and expand tax collection.

Given the scope of the changes and the potential for closer regulatory scrutiny from tax authorities, companies are advised to assess their payroll policies and implement relevant changes.

How SBA Stone Forest can help

- Customised analysis of the implications for your company and employees

- Support the drafting of company policy and handbook updates

- Employee communication support on key IIT changes and impact

- Technical training for HR team and employees

- Cost projections for budgeting/forecasting

- Implementation guidance for ongoing administration and continuous tax news updates

About Us

Established in 2001, SBA Stone Forest (SBASF) is a corporate advisory and public accounting group headquartered in Shanghai with offices in Beijing, Suzhou, Shenzhen, Chengdu and Hangzhou. We help foreign businesses set up in China and thereafter navigate its regulatory and business environment.

Discerning international businesses appreciate our Singapore heritage as it epitomises excellence, integrity and trust. We share the same systems, high standards, international best practices and service culture of our Singapore parent.

Together with our partner-owned public accounting practice, we offer expert knowledge and one-stop, hassle-free solutions for Audit, Tax Advisory & Compliance, Advisory (Equity Investment Management & Risk Management) and Business Solutions (Accounting & Advisory, Payroll & HR Advisory, Corporate Secretarial & Advisory).

We are also well-positioned to help Chinese enterprises internationalise, given our Singapore parentage in a top financial and business hub in Asia, and our membership in the Allinial Global international network.

For more information or assistance, please contact our team of Tax/HR professionals:

Emily Li, Director, Tax Advisory

T +86 21 6186 7998

emilyli@SBASF.com

Billy Zhu, Assistant Manager, Tax Advisory

T +86 21 6186 7993

billyzhu@SBASF.com

Marie Ma, Assistant Manager, Payroll & HR Advisory

T +86 21 6186 9516

mariema@SBASF.com