National Immigration Administration Adjusts Foreign Visa and Entry Policies

To coordinate COVID-19 prevention and control measures with economic and social development, and to promote personnel exchange between China and other countries, effective March 15, 2023, the following adjustments were made:

1. Foreigners with valid visas issued before March 28, 2020 will be allowed to enter China.

2. Visa-free policies will be reinstated in the following regions:

- Visa-free entry for visitors from 59 countries to Hainan

- 15-day visa-free travel for cruise groups at Shanghai ports

- Visa-free entry to Guangdong Province for foreign groups from Hong Kong and Macau SARs

- Visa-free entry to Guilin of Guangxi Autonomous Region for tourist groups from ASEAN countries.

In January 2023, foreign investment in China reached RMB 127.69 billion, a 14.5% increase compared to the previous year. In its efforts to attract more foreign investment, China is adopting a more open and inclusive approach towards the foreign market. The Chinese government is committed to improving the convenience and level of services for foreign experts working in China. This includes optimising work permits, talent visas, and residence policies, as well as improving tax, foreign exchange purchase, social security, medical care, and children education policies. These measures are intended to provide a secure environment for foreign talents to work in China.

A work permit provides foreign workers with the opportunity to work in China. Similarly, a work-type residence permit is necessary for a foreigner's legal residence in China. A residence permit allows for multiple entry visas, making it more convenient for foreigners to return home to visit family, travel abroad, or for work. It also provides foreign workers and their families with the convenience of living in China.

Legal Requirements for Foreign Employment in China

To work legally in China, foreigners must obtain work permits and work-type residence permits in accordance with relevant regulations. Employers cannot hire foreigners who have not obtained these permits.

Work Permit Application Criteria

The evaluation criteria for work permit applications vary depending on the category of the foreign worker. High-end foreign talents (Type A), foreign professional talents (Type B), and other foreign personnel (Type C) are all evaluated based on different requirements as outlined in the "Notice on the Full Implementation of the Work Permit System for Foreigners in China." It is crucial for foreign professionals to understand the specific criteria for their category to ensure a successful work permit application.

Understanding the Work-Flow of Hiring Foreign Employees in China

When hiring foreign employees, the company must apply for work permits and residence permits on their behalf. Expatriate staff must acquire an employment pass before starting any labour contracts in China.

The general requirements for an expatriate employee working in China are as follows:

- Is older than 18 years of age;

- Has good health status;

- Has no criminal record;

- Has relevant working experience (at least two years);

- Has relevant educational background; and

- Has relevant qualifications

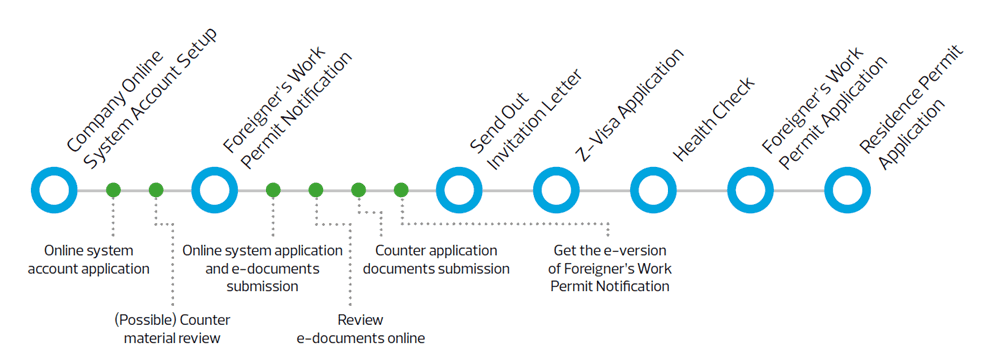

The entire process, from company account application to obtaining a foreign employee’s residence permit, usually takes about two months. The process is outlined below:

However, it is important to note that the specific application requirements and timelines may vary depending on the local regulations set by the authorities in each city.

Our Services for Expats

China Updates

Accounting and Taxation

- Electronic Invoice Management Guide

To promote the application and implementation of electronic invoices and support the development of the digital economy, the National Archives Bureau, together with the Ministry of Finance, the Ministry of Commerce, and the State Administration of Taxation, have created a "Guide for Electronic Management of the Whole Process of Electronic Invoices". This guide is based on relevant national laws and regulations, and standard specifications, and it summarises the experience gained from three batches of pilot electronic VAT invoices for reimbursement, recording and archiving.

- Deferred Tax Payment for Individuals’ Pension

Since January 1, 2022, a new preferential policy of deferred tax payment has been implemented for individuals' pension.

- During the contribution stage, the contributions made by an individual to their individual pension fund account can be deducted, up to a limit of RMB 12,000 per year, from their consolidated income or business income.

- At the investment stage, the investment returns included in their individual pension fund account are temporarily exempt from individual income tax.

- At the collection stage, the individual pension collected will not be included in the consolidated income, but will be subject to individual income tax at a rate of 3%, and the tax paid will be included under the item of "income from wages and salaries".

Human Resources

Corporate Governance

- China to Establish State Administration for Financial Supervision

On March 7, 2023, the "Proposal on the State Council's Institutional Reform Plan" was disclosed, revealing China’s plans to establish the State Administration for Financial Supervision, which will be responsible for the supervision of the financial industry except for the securities industry. The China Banking and Insurance Regulatory Commission will no longer exist.

- Simplification of Tax Information Change Registration Procedure

Effective April 1, 2023, taxpayers no longer need to report and register tax information changes to the authorities after registering changes with the Administration for Market Regulation.

Contact Us

Tan Lee Lee

Head of China

TanLeeLee@SBASF.com

Rita Boyle

Director, Business Advisory, International Desk

RitaBoyle@SBASF.com

Yeo Lee Soon

Director, China Business Advisory, Singapore

YeoLeeSoon@SBASF.com