To keep pace with the changing business landscape and remain in compliance with regulatory requirements, businesses in China should conduct tax health checks as part of their corporate governance. These checks, required by the Board of Directors, aim to mitigate tax risks and ensure compliance with prevailing laws and regulations.

The tax health assessment serves as a diagnostic tool for identifying tax-related issues. Through this assessment, the Board of Directors can thoroughly assess their tax structures, tax positions and tax compliance on an ongoing basis. Conducting these assessments periodically provides the Board of Directors with the assurance that tax risks are being managed and that appropriate compliance is in place. This, in turn, enables the business to be better prepared for tax audits and to have stronger tax positions.

The full implementation of Phase IV of the Golden Tax System (“System”) in 2024 represents an advancement from Phase III. This upgraded System extends its scope beyond routine tax matters, such as tax registration and filing, to include functionalities such as big data analysis, tax alert mechanisms, and fapiao (invoice) management enhancements, among other features.

By utilising the System, tax bureaus can establish internal tax metrics to evaluate each enterprises’ compliance probability and tax filing status. This allows them to then initiate inspections at random or on enterprises displaying abnormalities, irrespective of having completed the standard compliance procedures, such as tax registration and filing. Enterprises should exercise caution in their business operations to avoid potential compliance-related tax issues by the tax bureau through the System’s risk management capabilities.

Having mentioned the above, we have observed that Chinese tax authorities have significantly strengthened their administrative measures in recent years to combat tax evasion. Consequently, enterprises may, at their discretion, initiate a tax health check to verify their tax positions and mitigate tax risks.

The tax health check typically encompasses the following tax categories:

• Corporate income tax

• Value-added tax

• Consumption tax

• Withholding tax

• Real estate tax

• Stamp duty

• Individual income tax

• Land value added tax (where applicable)

It is recommended to conduct a tax health check:

• When newly appointed financial directors and tax directors need to clarify their tax responsibilities.

• When a new tax policy is implemented, significantly impacting the company's operations.

• When the company experiences sudden, sharp increases or decreases in its tax burden.

• When merging companies need to assess the tax-related treatment of the merged entity for compliance.

The benefits of a tax health check are as follows:

• Helps ensure that the current business operations of the Chinese company are in compliance with prevailing Chinese tax laws and regulations.

• Assists the company in identifying non-compliant business activities and provides effective solutions.

• Allows the business to explore tax planning opportunities to mitigate the overall tax burden of the company.

China Updates

Accounting and Taxation

- To support the development of Venture Capital Enterprises, which includes Venture Capital Funds, the relevant individual income tax policy issues are as follows:

1. A Venture Capital Enterprise ("VCE") may choose one of the two methods – Account for either a single investment fund or the VCE's annual income as a whole. It can then calculate the individual income tax payable on the amount derived from the VCE by its individual partners.

2. If a venture capital enterprise chooses to be accounted for as a single investment fund, its individual partners shall pay a 20% individual income tax on share transfer income and dividend and bonus income attributable to the fund. If a venture capital enterprise opts to account for its annual income as a whole, its individual partners shall pay an individual income tax on income obtained from the venture capital enterprise based on "operating income" and the super progressive tax rate of 5%-35%.

3. Accounting for a single investment fund (including a venture capital enterprise that is not established in the name of the fund) involves the treatment of income from equity transfers, dividends, and bonuses from various venture capital projects within a taxable year, applying different tax accounting methods.

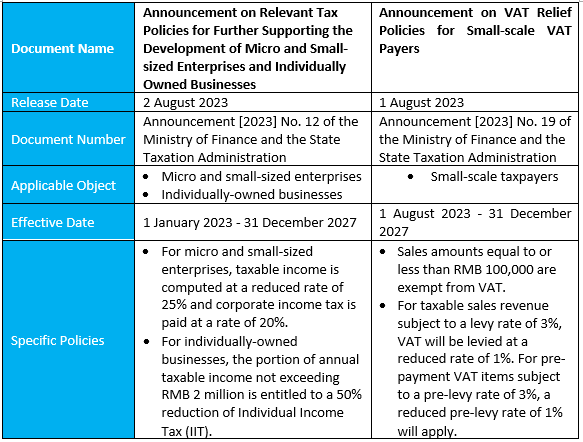

• To further support the growth of micro and small-sized enterprises and individually-owned businesses, the State Administration of Taxation (SAT) recently updated and issued tax policies aimed at reducing their tax burdens. A summary of these policies is as follows:

Human Resources

- Notice of the Shanghai Municipal Human Resources and Social Security Bureau and Shanghai Municipal Finance Bureau on Adjustment of Urban and Rural Residents’ Pensions in 2023:

1. The recipients eligible for the pension adjustment in 2023 for urban and rural residents are those who have completed the procedures for receiving a monthly pension in accordance with the regulations by the end of 2022.

2. The adjustment method entails an increase of 100 yuan per person per month to the basic pension.

3. Building on the pension increase outlined in this notice, the basic pension standard for urban and rural residents' pensions (including the minimum standard set by the central government) will be adjusted from 1,300 yuan per person per month to 1,400 yuan per person per month.

4. The expenses required to increase the basic pension in accordance with this notice will be shared equally between the municipal finance (including the central financial subsidy funds) and district finance.

5. This notice takes effect on 13 July 2023. The basic pensions of individuals who have completed the procedures for receiving monthly pensions from 1 January 2023 to the implementation date of this notice shall be adjusted in accordance with Article 3 of this notice. This notice is valid until 31 December 2024.

Corporate Governance

- The State Council released the “Guidelines on Further Optimising Business Environment and Attracting More Foreign Investment” on 13 August 2023. These guidelines include 24 measures across six key areas aimed at improving the quality of foreign investment utilisation, ensuring national treatment for foreign enterprises, strengthening the protection of foreign investment, enhancing investment and business facilitation, and providing fiscal and tax support. China intends to attract more foreign investment in sectors such as biomedicine, advanced manufacturing, digital economy, and others. The country will also gradually expand pilot regions for opening up value-added telecom services, such as domestic internet virtual private network services (with foreign ownership less than 50%) and information service businesses (restricted to App stores). Moreover, the country aims to refine the mechanisms for resolving international investment disputes and systems for administrative adjudication of patent infringement disputes, among other initiatives.

Contact Us

Tan Lee Lee

Head of China

TanLeeLee@SBASF.com

Rita Boyle

Director, Business Advisory, International Desk

RitaBoyle@SBASF.com

Yeo Lee Soon

Director, China Business Advisory, Singapore

YeoLeeSoon@SBASF.com